Within the HRM solutions, the “Payroll Management” module enables organizations to fully automate the entire payroll process from defining salary structures, updating attendance records, calculating earnings and deductions to generating payroll reports and individual payslips. Instead of handling payroll manually in Excel, the system consolidates, calculates and reconciles all data automatically, ensuring accuracy, speed and transparency in every payroll cycle.

Declare salary coefficient

Set up work hours and salary standards

Enter base salary, allowances, and deductions

Automate payroll calculation

Generate payroll reports - individual payslips - summary reports

The entire process automatically consolidates data on attendance, leave, bonuses, penalties, allowances, insurance and personal income tax, significantly reducing manual workload for HR and accounting teams.

Five smart payroll steps that streamline processes and save valuable time for businesses

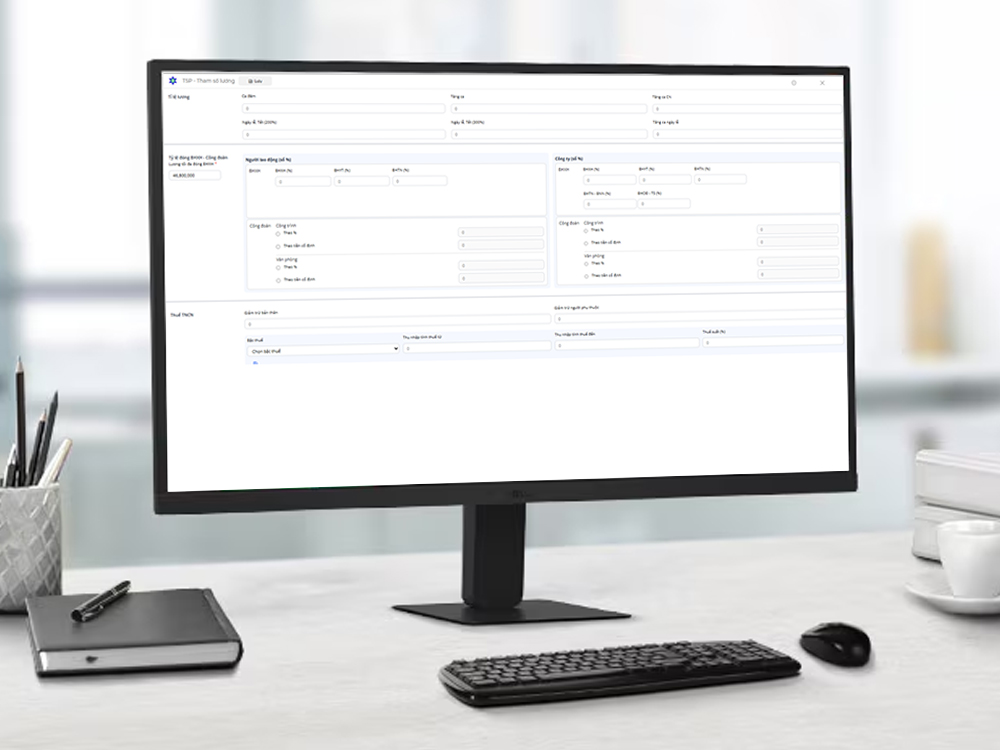

Users can customize salary coefficient to align with internal policies and the specific requirements of each unit, including:

Salary rates for different working hours (regular days, night shifts, Sundays, holidays)

Contribution rates for social insurance - health insurance - unemployment insurance - trade unions

Personal income tax configuration: allowances for the employee, dependents, tax brackets

Regional salary levels and other work standards

Whenever policies change, the system allows flexible adjustments, ensuring that all calculations remain compliant with legal regulations and company policies.

Declare salary coefficient details with precision, ensuring full compatibility with every business model

All incomes (allowances, holiday bonuses, performance incentives, commissions…) and deductions (advances, uniforms, penalties...) are recorded and stored on a monthly basis.

HR staff only need to enter or update information by employee ID, the system automatically captures and reflects it in the respective payroll cycle. This helps organizations maintain transparent control over HR expenses and ensures that all incomes and deductions are well-documented and justified.

The system automatically calculates payroll for the entire office based on actual attendance data, salary standards and declared earnings - deductions.

The payroll report displays comprehensive details, including:

Number of working days, leave days, holidays

Total incomes, total deductions, net salary

Contributions for insurance, trade unions, personal income tax

Users can filter by month, year or department, view details for individual employees, lock/unlock payroll records when finalizing a cycle. Individual payslips can be automatically generated and securely emailed, saving time for both HR teams and employees while ensuring complete confidentiality.

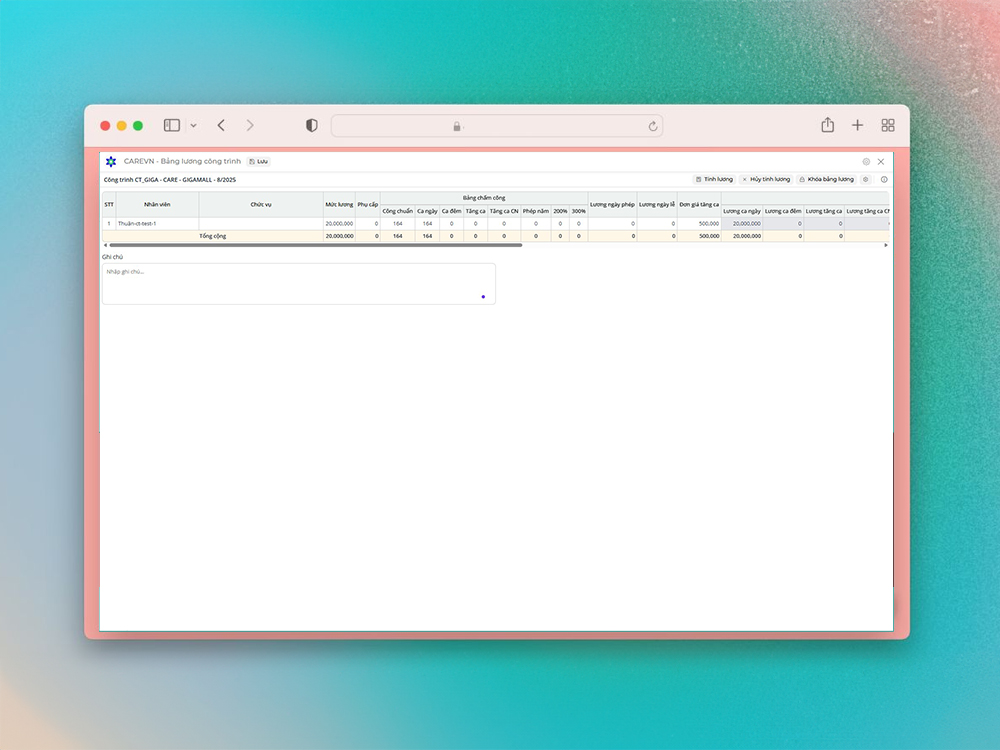

Easily manage payrolls by department or project, with complete and accurate real-time data

For organizations operating on a project-based model, the “Payroll Management” module allows users to:

Calculate and compare actual payroll against standards

Automatically consolidate HR costs by project, work zone or shift

Generate detailed reports: Payroll, payroll explanations, insurance, annual leave days and public holidays

This enables managers to easily evaluate performance, monitor costs and analyze profitability for each specific project.

The system automatically generates employee payrolls based on attendance data

The system supports personal income tax calculations for each employee (office-based or project-based), based on:

Total taxable income

Exemptions & deductions (employee, dependents)

Non-taxable income (lunch allowance, phone allowance, overtime)

The calculated tax is automatically updated in both payslips and total reports, making it easy for accounting teams to declare and remit taxes in compliance with regulations. All data is stored in an activity log to ensure transparency and easy traceability.

All data is encrypted, access-controlled and clearly permissioned.

The system supports bulk transfer file export or bank API integration if needed.

Payroll data is automatically synchronized with Attendance, Employee Profile, KPI and Insurance modules, ensuring a closed-loop, seamless and fully secure payroll process.

Save time and workforce in payroll processing

Minimize errors, data loss and miscalculations

Ensure transparency across the entire payment process

Support fast decision-making with real-time financial and HR reports

Increase employee satisfaction and trust with clear and transparent payslips

Payroll is a crucial part of digital HR management. When companies integrate the Payroll Management module with Attendance, Employee Profile, Leave Management, KPI and Training modules, all processes become automated - from recording working hours to salary payment, performance evaluation and employee development. This is the power of TSP’s integrated HRM system, enabling organizations to operate smoothly, maintain accurate data and elevate the overall employee experience.

---------------------------------

Contact information:

TSP

Address: P.1901, 19th Floor, Saigon Trade Center, 37 Ton Duc Thang Street, Saigon Ward, Ho Chi Minh City, Vietnam.

Hotline: 0909 411 885

Email: Cs@tsp.com.vn

Linkedin: https://www.linkedin.com/company/tsp-smartparking

Facebook: https://www.facebook.com/tsp.com.vn